Global health futures?

Reckoning with a pandemic bond

—

Abstract

Original: Ebola virus by Frederick A. Murphy/CDC https://www.osha.gov/SLTC/ebola/. Modification by Lukas Henne, 3 November 2015

Original: Ebola virus by Frederick A. Murphy/CDC https://www.osha.gov/SLTC/ebola/. Modification by Lukas Henne, 3 November 2015As government funding for public health care becomes increasingly forsaken, and as global investors elect to pick up where nation states have left off, practical and ethical questions emerge about the mechanisms through which collective health futures will be financed. Reckoning with these questions is urgent because new financial mechanisms to fund health are being established now, mostly outside of public view. The devices are complex and born of multiple and competing interests and perspectives. They force a reckoning: If money for pandemic emergency response is not otherwise available, should investors be able to make money speculating on pandemics? What does pandemic investability mean for our collective health futures?

As part of my research on the financialization of global health, I reckon with these questions through the emergence of the ‘pandemic bond’, which is the money-making part of the World Bank’s Pandemic Emergency Facility (PEF), a financial device designed to provide money for pandemics. My ethnographic entry point into this bond is the 2014–2016 Ebola outbreak in Sierra Leone, where I have worked for decades.[note 1] My interest in the bond emerged from a first research project, conducted coincidentally at the same time as the Ebola outbreak, in which I was ‘following’ health data, which led me to a second project in 2016 to ‘follow the money’.

The PEF appeared on the global health financial scene in 2017, decades after governments around the world chose austerity-driven cutbacks in health care or had them imposed upon them, weakening or underbuilding health care infrastructures. The governments of Sierra Leone, Liberia, and Guinea, and their respective health care systems, were severely challenged when the Ebola virus killed thousands of their citizens from 2013 through 2016. But health care response-ability (Haraway 2016) had been circumscribed in those West African nation states for decades. Domestic political strife and war had depleted treasuries, making monies far less available for health, education, and welfare. The World Trade Organization and international financial institutions such as the World Bank and the International Monetary Fund also hobbled the implementation of a Sierra Leonean health system and curtailed its capacity to respond (Kentikelenis et al. 2015; Zack-Williams 2012; see also Pfeiffer and Chapman [2010] for health impacts from structural adjustment and Basu, Carney, and Kenworthy [2017] for post-2008 impacts resulting from austerity policies).

In this context, Jim Yong Kim, a physician, anthropologist, and the then World Bank president, promoted the PEF as a response to those failures. In October 2014, Kim began publicly advocating for ‘a new pandemic emergency facility’ that would deliver ‘money to countries in crisis’ during future disease outbreaks (World Bank 2014a). It was a message he repeated three months later at the World Economic Forum in Davos, Switzerland, where he won over global financial thought leaders, many of whom had complained for years about the aid industry’s inefficiencies. Typically, after a disastrous event, donors pledge funds, but fewer than half fulfill their commitments (Grépin 2015). Shifting pandemic emergency response from bilateral and donor funding to Wall Street financing is meant to fix a central problem of crisis financing: money is unavailable at the optimal time to stop or contain a threat. (‘Wall Street’ is meant here in the metonymical sense, inclusive of global-capital market sites where people, institutions, and corporations can buy and sell financial instruments to make money.)

Kim backed the PEF, saying that if it had existed: ‘in 2014 during the Ebola outbreak in West Africa, we could have mobilized 100 million dollars months before money actually flowed at a time when the epidemic was only one-tenth as severe. Instead, it cost 10 billion dollars for emergency response, recovery efforts and in economic losses to the affected countries’ (World Bank 2016b). The next year, in his 2017 American Anthropology Association keynote address, Kim (AAA 2017) championed the PEF as a way to ‘insure the poor against pandemics’: ‘We went to the capital markets and we actually raised $450 million, now it exists! We have pandemic insurance! So the 74 poorest countries in the world, including Liberia, Sierra Leone and Guinea. … Now when Ebola happens, with the first case, we have a bunch of cash that will go right out to try and stop it. [Audience spontaneously applauds.] Thank you’ (emphasis added).

To be clear, the PEF does not insure poor people per se: it is not health insurance in the conventional sense. And despite what Kim said, the PEF money raised in the capital markets is not available at the first case of Ebola, or even the 249th. Until the official death count reaches 250, no money is released. And even then, there are other criteria to meet.

In what follows, I explore the pandemic bond portion of the PEF in more detail, but first offer some thoughts on the work that ‘reckoning with’ can do when a device like the PEF augurs new ethical economies of global health aid. Influenced by Nelson (2009), I use ‘reckoning with’ as an analytic concept to help think about measures and futures of global health in both economic and ethical registers. Reckoning with is a process, a way of taking account of where we are and where we are going. It is a pause that gives a chance for the unnoticed to be noticed. Reckoning with is not an undoing but rather a reflection in the moment. It makes space for some contemplation and understanding before condoning or condemning. We can consider: Does this financial device shape a world we want? In this case, reckoning with the PEF means considering not only the financial device (what does it organize and by what logics?) but also the relationships it cultivates (what does it bind together?) and reproduces (what kinds of relationships are strengthened and which are forsaken?). Reckoning with the PEF raises Simmelesque questions about the obligations and exchanges between people who have much and people who have too little. Reckoning with the means of financial and health inequities is important, which brings up a second way I reckon with: I take account of the counting, of the global health data that triggers the pandemic bond. Should a poor country’s health care failures become sites of wealth speculation and accumulation, which would be one way to merge poor people’s right to health with the obligation of wealthy people and countries to alleviate suffering? In embracing this new financing, what do societies give up? An Economist editorial suggests that the bond ‘means becoming less queasy about putting the words “profit” and “human suffering” in the same sentence’ (2017, 68). But the ethical heft of what the pandemic bond sets in motion is graver than overcoming an upset stomach. The PEF is a harbinger of future global health finance. What do we want to do about that? Maybe nothing, maybe something. That’s what ‘reckoning with’ means.

Governments shaped the public health successes of the last 150 years, but this is changing as they draw back under austerity dictates. Before deciding to endorse or denounce the fact of the pandemic bond, let’s stay with the trouble (Haraway 2016) long enough to see the world in which the privatized securitization of and for healthy futures is used to justify financial accounting mechanisms that create interest-bearing bodies (see Baucom 2005). Let’s reckon with living in worlds where it may be necessary to translate the ethical obligation to help those who are suffering into financial devices that make people money, a trend we are clearly in the initial stages of. One important data point to reckon with: everyone I interviewed who had worked to create the PEF – to the person – believed it was a moral good of a high order. So let’s consider whether in our current and future worlds investors deserve the ‘right’, as PEF advocates phrase it, to potentially make money off other people’s suffering because other remedies will not be paid for by governments, by ideological design. Are there conditions in which making money from the suffering of others is desirable and should be scaled up?

What is the PEF?

With the PEF, the World Bank brings together more than sixty diverse groups to frontload money for quick future disbursement if a qualifying pandemic occurs in any of the seventy-seven International Development Association (IDA) countries, deemed the world’s poorest by the World Bank. According to the World Bank (2016a), the PEF will deliver timely, faster, and more cost-effective pandemic response; more private-sector money involvement; improved transparency and accountability; a strengthening of health systems; and a new market. The PEF covers several diseases, including the Lassa and Rift Valley fevers, coronaviruses like SARS and MERs, and influenza. Because the pandemic bond covers Ebola, a disease that devastated a country whose economy I know well, Ebola is the disease I use as a touchstone reference throughout this article.

To clarify, the Pandemic Emergency Facility is not a facility in any kind of bricks-and-mortar sense. And although it is sometimes described as insurance, it’s not insurance in the classic sense that a person pays a premium and then receives money to cover losses from an event. And despite the fact that most of its money-raising capacity was offered to investors by the World Bank as a bond, it is not a conventional or ‘vanilla’ bond. With vanilla bonds, people or countries buy in, that is, loan their money for a predetermined duration of the bond, while something gets built or funded;. at maturation, a guaranteed principal and interest is paid out. Instead, the PEF is a multiaspected, largely speculative financial device – part insurance, part bond, part swaps, part cash grant – that is structured by contractual arrangements, many of which are legally binding, among the groups involved. These arrangements are detailed in a 386-page prospectus (World Bank 2017c).

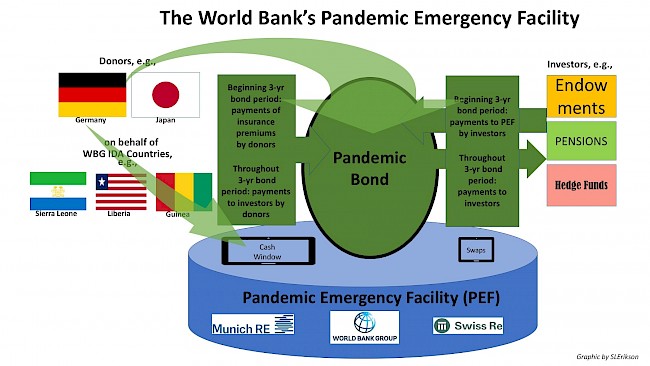

Figure 1. The pandemic bond as part of the World Bank’s financial device, the Pandemic Emergency Facility. Graphic copyrighted by author.

Figure 1. The pandemic bond as part of the World Bank’s financial device, the Pandemic Emergency Facility. Graphic copyrighted by author.The PEF works as a container (see figure 1). The World Bank PEF account ‘holds’ donor contributions, the pandemic bond, and swaps (an exchange derivative) that total US$450 million. It also hosts a ‘cash window’ bestowed with a 50-million-euro donation from Germany (to which Australia added US$7 million in 2018) and augmented by other World Bank money pots on an as-needed basis. Cash-window money can be disbursed on request and operates like old-style bilateral aid but with all decisions on payments from the cash window made by a PEF Steering Body (World Bank 2019, 3) rather than a country’s department of state or ministry of foreign affairs. In this article, I focus on the pandemic bond, not the cash pot, because the pandemic bond is a sign and symbol of the big change in humanitarian finance, as governments draw down and capital markets rise up to take over obligations for human health. Of course, these governments and capital markets are peopled, and the social life of the bond is the story I tell here as well.

For the insurance part of the PEF, the World Bank pays insurance premiums with donated money from Germany and Japan to reinsurance companies on behalf of the seventy-seven IDA countries covered by the PEF. The reinsurance companies, SwissRe and MunichRe, pocket those premiums paid by the donors. (In the future, the World Bank expects that countries facing pandemic threats will find a way to pay their own premiums.) That’s the insurance part. The bond part of the PEF launched in July 2017 when twenty-six investors bought into a three-year bond designed to raise US$320 million for pandemic response. Investors give their money to the World Bank to hold for three years. Some investors paid US$250,000, the minimum qualifying amount; some invested US$50 million.

If there is a pandemic during those three years, the World Bank (2019, 3) gives some of the investors’ money to ‘responding agencies’ to administer emergency care:

PEF funds can be used to finance the cost of response efforts during an outbreak, in line with what is described in the country response plan. This includes, but is not limited to, deployment of human resources, drugs and medicines, essential and critical lifesaving medical equipment (including personal protective equipment), logistics and supply chain, non-medical equipment, essential life-saving goods, minor civil works (such as setting up temporary care centers), services, transportation, hazard payments, communication and coordination, etc.

There are restrictions: The maximum payout, for example, for filoviruses, of which Ebola is one, is capped at US$150 million. Also, PEF funds cannot be used for preparedness: ‘Funds will only be made available in times of crises, when countries have been affected by an outbreak’ (World Bank 2019, 4). And the standing pre-vetted ‘PEF-accredited responding agencies’ have been limited to four: World Health Organization (WHO), United Nations Children’s Fund (UNICEF), United Nations Population Fund (UNFPA), and Food and Agriculture Organization (FAO). IDA countries and aid organizations can apply to become a PEF responding agency by submitting an application. A World Bank–chaired steering committee of no more than seven voting and five nonvoting members decide which organizations qualify as responding agencies and get PEF funds (World Bank 2017a, 9).

If there is no pandemic during the three years, the investors get back their money, plus interest. If they invested in the higher-risk portion of the bond, they will get back the money they put into the bond plus annual interest of about 14 percent.[note 2] If a PEF bond investor invested US$50 million (there were reportedly such investors), they would receive annual interest of about US$6.81 million. Over the three-year life of the bond, they would earn about US$20.43 million in addition to getting their US$50 million back. An investment of US$50 million becomes approximately US$70.5 million in three years if there is no pandemic event.

Semiannual interest payments are paid to the investors with the money donated by the German and Japanese governments, an aspect of the bond’s design that Stein and Sridhar (2017) suggest is unsustainable. That donor money, which is earmarked as humanitarian aid, could otherwise go directly to pandemic relief. This has prompted criticism about whether the money should be given directly as aid, an opinion that has gained some traction in European and North American aid circles.

If you find the PEF’s operational mechanisms confusing so far, it’s not you. The PEF is confusing, I found, even to people working in the finance industry. At the World Bank, I met people who understood singular ‘silo-ed’ elements of the PEF very well but were not able to answer questions about other parts. Part of the problem is that the PEF combines aspects of many different financial products, so that a public health expert may not fully understand the insurance elements and vice versa. As a financial device, it is clever but also confusing, and I was not surprised to learn it took more than two and a half years to design. It had to be made up laboriously, combining features of the finance industry with pandemic public health measures.

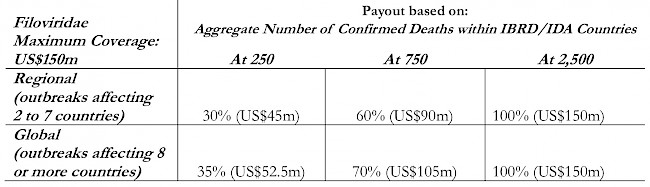

The design element that took the longest time to create was the payout triggers. Money is released (or not) for emergency care depending on the number of confirmed deaths. In the event of a future Ebola outbreak in Sierra Leone, for example, no money from the pandemic bond is released for a single case or for any cases up to the 249th. When the 250th death is officially counted and other criteria are met, US$45 million becomes available, which is 30 percent of the money designated for filoviruses, of which Ebola is one. Sixty percent is available when 750 deaths are documented. One hundred percent, US$150 million, of the bond money designated for filoviruses becomes available when the official count reaches 2,500 deaths. Other qualifying criteria are written into the bond contract too: no matter how many deaths occur within a country, payout is only permitted when cases occur in two bordering countries or in a total of eight noncontiguous countries (see table 1).

Table 1. World Bank table showing pandemic payout amounts for filoviruses Source: World Bank (2017a, 7)

Table 1. World Bank table showing pandemic payout amounts for filoviruses Source: World Bank (2017a, 7)Note: 100 percent payouts do not equal the total US$320 million paid in because no single qualifying epidemic event (such as Filoviridae viruses like Ebola) can claim all the bond money raised.

Further, as in the recent Ebola outbreak in the Democratic Republic of Congo (DRC) (which began 1 August 2018), there is also a ‘growth rate’ threshold, that is, a number and case growth calculation, that must be met for the investors’ money to be released (World Bank 2017c, PT-32). As of this writing, there are more than two thousand confirmed deaths, with a few additional deaths over the border in Uganda, but the growth-rate threshold is still being analyzed. In later sections, I take up the practices and politics of the death counts, but first I provide a genealogy to explain the pandemic bond as a logical outcome of changing humanitarian-aid practices.

The pandemic bond is born: A genealogy

The World Bank expanded its bond ‘family’ when it issued its pandemic bond in 2017. With its first green bond issuance in 2008 and its first catastrophe bond issuance in 2014, World Bank–backed bonds have become more complex with each generation. Green bonds work in the conventional way of raising money: A bank issues a bond on behalf of, for example, a government goal. Investors buy in, and if the goal is met by a certain deadline (the life of the bond, usually three to twenty years), the bank, for a fee, pays investors back the money they put in and the government pays them interest. During interviews, World Bank economists referred to green bonds – designed to build environmentally sound (‘green’) facilities and programs – as ‘vanilla bonds’ for their lack of complexity. World Bank officials consider green bonds a precursor to the more complex World Bank–issued catastrophe bonds, which in turn inspired pandemic bonds. With the issue of the pandemic bond, the World Bank hopes to catalyze a pandemic bond market in the way that the World Bank fostered the development of the green and catastrophe bond markets.

The World Bank is considered at the forefront of ‘innovative financing for development’. But it is not alone: the United Nations (2009) has been promoting financial innovation for almost a decade, and the Rockefeller Foundation has made a hard push for an ‘innovative finance revolution’ (Madsbjerg and Keohane 2016). ‘Advancing universal development goals through the breathtaking power of [financial] innovation’ (Nabarro and Schroeder 2016, 100) is a concept already well embedded in some international-development and humanitarian-aid circles. The Gates and Clinton foundations have advocated financial innovation since about 2010. In rich and poor countries alike, something was needed to make up for the tax-revenue shortfalls in health, education, and social-welfare provisions resulting from the neoliberal austerity schematics introduced in the 1980s.

Market remedies have become the prescriptive fix, ushering in the current era of what is called ‘impact investing’.[note 3] If investors are willing to risk their money on the chance that their money may be lost, the logic goes, then they deserve to make money. Taking on financial risk for the public good should be rewarded, according to this view. ‘Paying for success’ has become the mantra of impact investing and financial devices known as social impact bonds (SIBs) and development impact bonds (DIBs) have proliferated in earnest.

SIBs got off to a precarious start, beginning with the first one issued in England in 2010. The Peterborough Prison SIB did not meet its goal of reducing recidivism, but it set a financial precedent nevertheless because the bond device was considered a success. This raises a key critique of impact-bond logic: the social goal need not be fully met if the bond device works to deliver financial returns to investors.

The first SIB issued in the United States was launched in 2012 to reduce the number of sixteen-to-eighteen-year-olds returning to New York City jails within twelve months of their release. The goal was to cut recidivism rates through a brief cognitive behavioral therapy intervention. Goldman Sachs, who operated as both the bank and the investor, put up US$7.2 million and stood to make between US$500,000 and US$2 million if predetermined benchmarks were met (City of New York 2012). The therapy program failed, and Goldman Sachs lost some of its money (the US$7.2 million loss was reduced to a US$1.2 million loss by a US$6 million backup guarantee paid by Bloomberg Philanthropies). The failure of the bond to meet its goals is well known among SIB advocates, critics, and fence-straddlers alike (see, for example, Rudd et al. 2013; Cohen and Zelnick 2015; Dodge 2015, respectively). But the bond device worked as designed, and a model was born. Since then, the number of SIBs has grown: as of 2018, there were 108 SIBs in twenty-four countries (Rosenberg 2018). Most have not yet come to maturity.

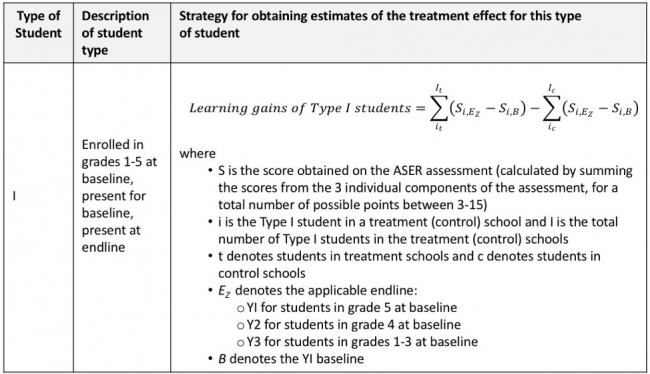

Development impact bonds (DIBs) followed, applying SIB tenets to international development. The first, the Educate Girls Development Impact Bond – a three-year bond that raised US$270,000 to improve educational outcomes for girls in Rajasthan, India – was launched in 2015 and matured in June 2018. The investor, UBS Optimus Foundation, stood to make money even if results fell short (Instiglio[note 4] 2015, 15).Projections were that if education targets were fully met, the investor would get back its principal investment of US$270,000 plus US$89,085. Even if the outcomes met only 86 percent of the projected performance, the investor would get an additional US$36,657, a 13 percent return on investment (Instiglio 2015, 5). The interest payment was paid by the Children’s Investment Fund Foundation, a charity created by a former hedge fund manager, who would be able to write off the paid interest as a tax deduction.

When the bond was initiated, the investor was speculating on trial outcomes three years in the future. Their payout was determined by calculating student-learning outcomes using standardized tests in clustered randomized control trials (see table 2). Outcomes would eventually trigger the amount of investor return. Putting the debates about standardized testing and randomized control trials in education aside, this SIB example highlights how outcome data was used to make the investor money, an issue that affects the pandemic bond as well.

Table 2. Educate Girls Development Impact Bond table for calculating learning outcomes Source: Instiglio (2015, 30)

Table 2. Educate Girls Development Impact Bond table for calculating learning outcomes Source: Instiglio (2015, 30)Results from its first two years suggested that the DIB was unlikely to meet its education and inclusion goals fully (IDinsight 2018, 8). But by year three, the Educate Girls Development Impact Bond had officially exceeded its enrollment and learning targets. The investor got their principal back plus 52 percent interest (US$270,000 + US$144,085 = US$414,085), as was directed by the bond contract. But measurement challenges troubled this bond, which comes to light in the eleven pages of footnotes and appendixes to the final evaluation report, half of the twenty-two-page report (IDinsight 2018). Numerous dubious and debatable decisions made by the Working Group[note 5] highlight just how central data is to bond investing. Working Group members needed the bond to work as an investment; that is, they needed it to succeed in paying out to investors. Decisions about the data reflect this; the data machinations were extensive. Questions about what to do with age-grade dissonance, for example, prompted footnotes like this: ‘An 8-year-old child in grade 3 during Year 3 Endline is shown as a 6-year-old child in grade 1 in this table’ (IDinsight 2018, 16). Debates within the Working Group about how to count learning gains inspired this decision: ‘The Working Group agreed to err on the side of overestimating learning gains for this group by assuming that the effect of the Educate Girls program on students not assessed at Baseline in grade 5 were the same as the effect on students assessed at Baseline’ (IDinsight 2018, 19). Some of the descriptions of what counts were simply nonsensical.

Measurement qualifiers, especially in the third year, were copious: ‘Newly-enrolled girls were omitted from all analyses’ (IDinsight 2018, 20). Students dropped out. A few schools closed. Some schools were dropped by the Working Group. In year 3, after years 1 and 2 were less than promising, the service provider increased remedial tutoring sessions for some students to twice a day, along with home visits. The service provider reported spending US$12 per student per year, when less than US$5 per student was usually spent on students in that region (Brookings 2018, 16). The point is not to belittle the measurements but to point out that behind the conclusion that ‘DIBs are successful!’ lies sometimes dubious and often debatable data-analysis decision making. Serious questions of long-term, population-wide applicability and sustainability abound and are cause for concern. For example, who will educate students who do not measure up in any given year when investors only pay for success?

There is one more essential precursor in the pandemic bond’s genealogy: the rise of catastrophe bonds (called ‘cat bonds’). Introduced in the mid-1990s, cat bonds are bonds of one to three years, sold by banks and purchased by private investors willing to ‘hold’ the chance that an insurance company will have to pay out claims if a catastrophe happens. Investors make money when they hold the bond for an event that does not happen (and that insurance companies do not pay out for). Natural disasters like hurricanes, earthquakes, wildfires, meteorite impacts, and volcanic eruptions fall into this category of investment device. Extreme mortality bonds were introduced in the mid-2000s to protect insurance companies against ‘losing too much money’ to life insurance claims in the event of a catastrophe. Investors bet on bonds speculating on the where, the magnitude, and the timing of the catastrophe.

In June 2014, as the Ebola pandemic raged, the World Bank had just issued its first cat bond, raising US$30 million, covering earthquakes and cyclones in sixteen Caribbean countries. Although the bank was about twenty years late to the party, its new cat bond was hailed as ‘innovative’ and a ‘milestone’ (World Bank 2014b). The then president of the World Bank Jim Kim took credit for putting the two – the Ebola pandemic and the cat bond model – together (AAA 2017). The PEF, with its catastrophe bond–like device and a 50-million-euro cash pot, became a signature contribution of Kim’s tenure.

It is important to reckon with this part of the genealogy: the pandemic bond grew out of a neoliberal milieu in which earlier precursors – SIBs, DIBs, catastrophe, and extreme mortality bonds – were hailed as the remedy to ‘bad, slow government’. The pandemic bond is a manifestation of larger trends away from direct investment in health care systems–infrastructure and toward pay-for-performance financing (Soucat et al. 2017) and accountable-care systems (McClellan et al. 2014). Never mind that governments have orchestrated astonishing public health improvements over the last 150 years (Rosling 2010): innovative global health financing eschews governments, and making money on disease is considered a problem-solving ‘win-win’ by many of the people I interviewed.

At the World Bank, I encountered a widespread embrace of development projects and products that provide ‘return’. When I asked my interlocutors there about future developments and whether to expect a pandemic bond 2.0, one of them said that the pandemic bond 1.0 issuance was a test to see if it functioned as imagined: ‘It’s proof of concept. … It’s a pilot and we’ll see how it goes. … [A 2.0] to a large extent, depends on whether the 1.0 triggers or not. Part of me is like, “I hope there isn’t another public health outbreak with pandemic potential”. But another part of me says, “Well, until that happens, we can’t really test it”’. In the summer of 2019, the World Bank announced it is working on a PEF 2.0.

Finance sociality: Relationships strengthened, relationships forsaken

The development of the bond portion of the PEF was, by many reports, a creative, iterative, and exciting process. For some, it was completely nerve-racking. ‘It was my life for two years’, a financial analyst said, sounding both proud and exhausted. A core group of officers from World Bank departments – Treasury, Health, and Development Finance – developed the bond using various exemplars from successful green and catastrophe bond issuances. As the PEF developed, the World Bank brought in reinsurance companies, a bond-brokerage company, and a data-modeling company to structure the bond.

When it came time to solicit investors, the World Bank turned to a familiar bond broker, the Guy Carpenter company.[note 6] A cat bond investor told me: ‘[The relationship between the World Bank and Guy Carpenter] is a typical kind of investment banking relationship. … [The World Bank] needs to turn to some expert who deals with us as investors every day. [Guy Carpenter] knows the whole universe of investors who have bought bonds before, what they’re thinking, who would care or not care. That’s their value to the World Bank’.

‘The whole universe of investors’, as it turns out, is a rather stable group of people. No mom-and-pop investors are allowed. Only institutional investors approved by the US Security and Exchange Commission (SEC) will do. (An SEC-accredited investor has to have earned at least US$200,000 in each of the prior two years and have a net worth over US$1 million. Banks, partnerships, corporations, nonprofits, and trusts may be accredited investors if their total assets exceed US$5 million or if all of the equity owners are SEC-accredited investors [SEC 2013].) SEC rules specify that an investor must be ‘sophisticated’, meaning that ‘the [investor] must have … sufficient knowledge and experience in financial and business matters’ (SEC 2013, ‘Who Is an Accredited Investor’). During an interview, a World Bank officer mentioned ‘going on a roadshow’ to look for investors:

SLE: The roadshow? I’m sorry, but I don’t know what that would mean for the World Bank to – ?

WB: Oh, so that would just mean we went to some cities, you know, to London, Zurich, Tokyo, New York, where we spoke with the bond investors and explained to people who were potentially interested in investing in this pandemic bond. We explained it to them.

SLE: And at any point did you seek investors or share the model in Sierra Leone, Liberia, or Guinea?

WB: No, we have a Steering Committee[note 7] for that.

From the World Bank’s perspective, the pandemic bond needs to work, and to work it needs to draw the ‘right’ kind of attention from the ‘right’ people. This meant getting investor buy-in from wealthy established capital networks. More than 80 percent of the investors covering the Ebola portion of the PEF are in Europe, with dedicated cat bond investors (35 percent) and pension funds (42 percent) making up the investor type (Artemis 2018b). Sierra Leoneans, Liberians, and Guineans (and people from other qualifying recipient countries) are imagined only as the intended recipients of a pandemic payout. They were not consulted in the making of the bond.

In 2016, about fifty senior health and national-security officers from Africa, North America, and Europe met near London. Three G7 governments hosted the meeting to share lessons learned from the Ebola outbreak. I was invited to explain the financialization of Ebola. After I finished explaining how the PEF works as a new form of pandemic financing, a high-ranking African officer immediately commented: ‘We’re not in this. I have never heard of this’. That officer and others around the room were visibly upset. At issue was the lack of consultation with African leaders in the making of the bond. Later, when I joined a lunch table where several country officers were eating and discussing the pandemic bond, the general tone had shifted to one of resignation. By the end of lunch, I left the table with the impression that during a national emergency like the one posed by the West African Ebola outbreak, it did not matter much where the money came from. Just that some came.

But, in a pandemic, is it always the money that matters most? This presumption begs reckoning with. Yes, of course, money is absolutely necessary to respond to pandemics. But during the Ebola outbreak, nonfinancial factors also severely affected disease containment (see Wilkinson and Leach 2014; Shepler 2017), most of which were minimized, in my findings, when compared with the World Bank’s aggrandizement of the PEF. And what of the big development banks’ responsibilities for economic structuring failures in Sierra Leone, those that stunted the growth of a health care system capable of thwarting early cases of Ebola (Kentikelenis et al. 2015)? Might the pandemic bond be part of a contemporary impact-bond juggernaut that is ‘a dramatic expansion of economic rationality and its penetration into new areas of human life’, when best practices like local consultation fall away in pursuit of capital (Cooper and Konings 2015, 2)?

Making what global health becomes

Among the people I interviewed, there was a widespread belief that the PEF was a moral good and that the financial performance of the pandemic bond would set in motion the future conditions of global health. In making the pandemic bond, development banks, reinsurance companies, data analysis firms, and investors aim to design anew what the field of global health becomes. For centuries, governments unceremoniously – and often unprofitably – held our collective disease-security risks, but now we are in an era of private takeover of and profit from that obligation. The global financial powerhouses who made the PEF believe the private sector should take over government tasks. By their logic, investors who ‘buy’ the risk of a pandemic deserve to make money; and they aim to cultivate a pandemic bond market that will establish and provide pandemic-response financing in perpetuity. They may be wrong, but increasingly they hold the power to shape global health futures to their liking and advantage. They design humanitarian devices, structure processes, and determine triggers. They do this outside the realms of democratic processes, without constituents constitutionally empowered to complain, critique, or improve.

Reckoning with their imagined global health futures means reckoning with the neoliberal logics and metrics that are taking us there. Making the pandemic bond is not only about constructing a vehicle in which both investors and pandemic responders share the chance to make money. It’s also about constructing another capital market for investors, including the reinsurance companies and development banks themselves, to diversify their portfolios. Diversifying investment portfolios is a common investment strategy, as different kinds of investments are not likely to lose money all at the same time.

An investor summed up for me the World Bank’s leadership role in the promotion of the pandemic bond market: ‘The bond relies heavily on the World Bank. Without their credibility and stamp of approval on this, it wouldn’t have been issued. … So it’s very important that everyone agree to what the deal is that they’re entering because, god forbid something happens, everybody’s got to be on the same page because otherwise the market doesn’t grow’. The World Bank understands that the market they are trying to cultivate with the pandemic bond is not something found ‘out there’ but rather something that must be painstakingly constructed. The bond’s designers aim to catalyze the future conditions of a global health field that will be able to rely on capital markets for funding.

It took two years to develop the PEF bond, and it was created with the hope that it would create a new market, a market for transferring the risks of outbreaks and pandemics from governments to private investors. Officially, according to the World Bank, ‘the PEF is expected to play a key market development role by helping create a new market for pandemic risk insurance. The private sector may take this forward on its own in a few years. … It is likely that over time, as the market matures, the PEF will scale up and pricing will become more competitive – as has been seen with catastrophe risk insurance facilities’ (World Bank 2016a, iii). The World Bank is counting on the pandemic bond to perform well enough to establish a pandemic bond market, much as the green and cat bond markets have over the last ten to twenty years. The growth of the green bond market established a solid faith in development bonds, but it was the catastrophe bond market – that mechanism for investing in natural and climate disasters – that set the sights and expectations for the pandemic bond market. The cat bond market took about fifteen years to mature and stabilize. Now it is thriving, valued at US$40 billion (Artemis 2019, as of 2 September 2019). Pensions are invested in the cat bond market with regularity. An investor pointed out, ‘From the investor perspective, many years went by where there wasn’t a loss in the cat bond market, so that helped a lot’.

If investors regularly lose the money they put into the pandemic bond, the market will cease to exist, and the pandemic bond will be considered a market failure. But it is completely possible that pandemic bond devices may successfully yield profits that will build a market but not correlate to disease containment and improved health outcomes. This is because only the data has to meet the contracted measures to profit. Much like Dumit (2012) and Sunder Rajan (2012) found with pharmaceutical profiting, well bodies and populations can become secondary. In essence, investors do not need to care about disease containment, only about the data representing disease containment. And if the pandemic bond performs and makes money for investors, that success will spawn other instruments like it and a new market will be born.

Speculative finance is now poised to catalyze what global health becomes. Caring about data that supports investor return may not necessarily correlate with well-body outcomes. We need to reckon with health data and health care systems that may soon need to be even more investor friendly. Many people say we can do both, but let’s interrogate that declaration, starting with an examination of how the data that determines returns on the bond actually works.

Reckoning the dead (I of II): Modelling Ebola risk

If there is a single element that could shake investors’ faith in the pandemic bond and undermine a future pandemic bond market, it’s the triggers. The numbers. The assignation of financial risk. The counting of the dead. It made sense when a World Bank officer told me: ‘The investors asked a lot of questions about the data and the veracity of the data and the trigger, because for them, that’s what matters the most. … The triggers took the most time to set up’.

In conversations about the pandemic bond and Ebola, there was a lot of slippage between the 250, 750, and 2,500 death triggers and the counting of the dead. But they are not the same. The triggers work on two registers. This section takes up how risk is defined and assessed by modelers and how investors assess their financial risk via the triggers; the next section takes account of how the dead are counted (and not counted) relative to the trigger thresholds.

The pandemic bond’s parametric triggers were assessed relative to the risk of a pandemic for investors, that is, the risk that they would lose their money, rather than the risk of pandemic for the people who would experience it. Data modelers hired by the World Bank assess this risk statistically. They start with retrospective WHO population health data and add data from other sources.[note 8] Parametric measures are data points projected for a given population using historical inputs and conditions chosen by the data modelers. It is a biostatistical exercise employing biostatistical conventions that include sampling and projection.

What data modelers bring to the project are models that help investors determine how risky the bond is, that is, the chance that they will lose their money. This is central to the bond as a speculative enterprise. One data modeler explained probabilistic modeling to me this way:

Data modeler (DM): No one claims that whatever’s presented is 100 percent representative of what’s going to happen. That’s why we do five hundred thousand years [of probabilistic modeling] because we want to consider all the feasibilities. Some things we can’t see, some things that are very severe, some things that are less severe, and that’s why we do probabilistic modeling.

SLE: Five hundred thousand years of modeling?

DM: Pick January 1 as your start date to December 31. [We model] what could happen from a pandemic or a large-scale epidemic or something like that if you resimulate [all the variables for a] whole calendar year five hundred thousand times. It’s the same thing as if I roll the die five hundred thousand times. You’d have lots of outcomes of that. You can run the probabilities many, many, many times until you see convergence [patterns in the results]. That’s why we selected five hundred thousand times to be able to figure out what might happen, based on the historical data and possibilities that we have.

Using the triggers as a guide, investors figured out the chance that they would lose their money or make a profit. The risk of death, and therefore of financial loss, is translated into financial risk for the investors. Details on this are deep in the fine print of the Prospectus Supplement (also called the ‘Term Sheet’) (World Bank 2017c, appendix II).

Thinking about the triggers as absolute thresholds is misleading, I was told, because they are meant more as intermediaries, as modes of thinking about risk. A modeler explained:

With the outbreak bond, you have the person selling the risk [the World Bank] and the person buying the risk [investors]. When we were on the investor roadshow, we were not necessarily trying to sell them that the 250 [death trigger] is right or the 750 [death trigger] is right. Our objective is to say our model can estimate these various numbers with reasonable accuracy. … We operate as this third-party thing, trying to not be biased in one’s favor or another. We’re trying to create what we believe is a reasonable estimate of the risks. We have to just go with best available data to get there [to set the trigger].

Like the making of a market, establishing a parametric trigger takes serious effort. The modeler continued:

The parametric model is kind of a weird structure. You could do a myriad of different ways that the structuring can get made, and our objective is to give [the World Bank] quantifiable risk against a lot of different assessments. When they ask a question, we might provide just that one: ‘Oh, you asked about A, here’s the risk’. Or we might do a few different things and say, ‘Here’s a few options based on what you said’. Or they might sometimes just say, ‘Before we do A and B, have at it and figure something out for us’, and then we’ll come up with an option, and then they’ll look at it and then be like, ‘We wanted to do some more stuff around it’, then you do that kind of stuff. So it’s this back-and-forth process.

Another modeler joked, ‘All the models are wrong, but some of them are useful’.

In the end, data modelers used their pandemic-risk model to help write conditions that were not likely to result in too much investor loss. The World Bank’s (2017a, 6) Operations Manual lists these conditions, which need to be met before investors lose their money in an Ebola outbreak event.

At least 12 weeks have passed from the start date of the event.

The outbreak is in more than one country, with each country having greater than or equal to 20 Confirmed Deaths.

The Growth Rate of disease needs to be greater than zero to ensure that the outbreak is growing at a specific statistical confidence level.

The Total Confirmed Death Amount needs to be greater than or equal to 250.

The Rolling Total Case Amount needs to be greater than or equal to 250.

The Rolling Confirmed Case Amount needs to comprise a minimum percentage of the Rolling Total Case Amount.

Regional outbreaks affecting two to seven countries would activate payments at three stages as the number of total confirmed deaths increases. Global outbreaks affecting eight or more countries also activate payments at three stages, but at higher funding levels at the first two triggers.

In talk about the pandemic bond as a financial device, there is regular and unself-conscious slippage between risk to investors and risk to people who are likely to experience the disease. Many people I interviewed talked about the two kinds of risk as if they were one and the same, when of course they are not. A deep reckoning with the pandemic bond forces an essential confrontation: for some people, the stakes are about losing or gaining money; for others, the risks are death or long-term disability. The numeric triggers obscure that difference, thereby creating another risk: losing sight of which risks to prioritize.

Reckoning the dead (II of II): Taking account of the counts

In World Bank documents, investor synopses, and bond blogs, the numeric triggers of the pandemic bond (table 1) are characterized as clear-cut and uninfluenced: ‘Parametric [health] triggers use publicly available and observable data to determine the payment amounts. As these triggers are based on observable data, they provide more transparency, increase the speed of payment and allow for an objective benchmarking of risk. … Bonds would be constructed around the same transparent and indisputable activation criteria’ (World Bank 2016a, 13–14).

What is striking in conversations about the pandemic bond with reinsurance, data-modeling, and finance personnel is the enduring faith they place in the triggers. Even when data limits are acknowledged, the prevailing sentiment was: ‘they’re the best we’ve got, and we’ve got to use something’. Counting the dead is beset by a similar sensibility. The pandemic bond uses counts published in WHO Disease Outbreak News or Situation Report, and there is faith in that data. When I interviewed one World Bank manager of the bond, I found that my knowledge of data collection in Sierra Leone was more granular than theirs:

WB: It’s data that WHO puts out. … WHO puts out those numbers in the moment.

SLE: By the month, or –

WB: No, they take it in real-time. You should talk with the health team because they’re the ones who gave us the assurance that WHO is doing this really in real-time.

SLE: Thank you, yes, I’ll follow up. In my research, though, I travel around with the people who collect the numbers for WHO. … I mean, I know the guys who collect the numbers in Sierra Leone.

WB: Okay. Alright. Well. … I’m a third-party receiver of the numbers. I don’t know whether it is a suspected case or a probable case or a confirmed case. I don’t track that. That’s not my job. It is WHO’s job, so we entrusted them with that responsibility. That is the data that we go on. … There was sufficient comfort, you know, in the data the WHO provides.

During research in Sierra Leone in 2014, our team collected ethnographic data on how health data is generated. In Freetown, the capital city of Sierra Leone, and in small cities in the eastern and northern provinces, we met with, interviewed, and observed the work of people involved with health-data generation. In the process, we learned that Sierra Leonean freelance enumerators are the most significant group of data collectors in the country. A cohort of mostly men and a few women in their twenties and thirties, these enumerators work on short-term contractual bases for any organization that ‘needs numbers’. For example, an enumerator is hired to collect data in twenty villages from people who suffer from a disease. Their job is to travel to these villages in, for example, two weeks’ time, collect disease data, and usually fill in a survey on a smart phone or tablet. That may sound straightforward, but in actual practice it is not. It’s precarious wage labor, complicated by language – in Sierra Leone there are about twenty different languages spoken in an area the size of Scotland – and further by work schedules often put together by people who have never been to Sierra Leone or driven on its roads (see images in figure 2). Nor do they understand the precarious rhythms of labor and labor mobility during the dry and rainy seasons. Collecting health data in Sierra Leone is physically and socially demanding work, and during an epidemic, be it cholera, measles, or, Ebola, even more so. One enumerator described the challenge: ‘The last time I went to Kailahun district [a region where the early Ebola outbreak occurred] I walked twenty-one miles to go to a village and twenty-one miles to come back. When you go to the field, your very first problem is how far it is. … Just imagine walking twenty-one miles to go and twenty-one to come back, and you have four villages to cover!’ Another Sierra Leonean enumerator mentioned similarly, ‘Enumerators have to go through frightful and dangerous roads. There is water, bridges, and bush paths in forests. Dangerous!’

Figure 2. Rural bridges and roads in Sierra Leone and Liberia, 2013. Left-hand photograph by J. B. Dodane, right-hand photograph by Travis Lupik, both used with permission.

Figure 2. Rural bridges and roads in Sierra Leone and Liberia, 2013. Left-hand photograph by J. B. Dodane, right-hand photograph by Travis Lupik, both used with permission.To enhance data security, employers track enumerators via the Global Positioning System (GPS) in their phones. There is not always enough time to complete all the villages assigned and do all the paperwork. One enumerator’s statement summarizes what several others also said: ‘I have heard that sometimes people will send their smart phones with lorry or motorcycle drivers to a village, while they fill out the questionnaire, because there is just not enough time to do everything they want’. (See also Kingori and Gerrets [2016] and Biruk [2018] on the moralities and realities of data fabrication by fieldworkers.) But there are risks to this strategy, as noted by another enumerator:

The last time I went, [the WHO-contracted NGO] gave us PDAs [later, smart phones] to know if we went to the communities. They knew the GPS [Global Positioning System] coordinates of the village, so now you have the questionnaire and also a GPS. Now they detect you. … If they detect that you have not gone, they will send you back there. And maybe charge you with the full punishment of the law for giving them wrong information. They will retrieve your money they paid you.

Certainty about the health data down to the last digit is not possible. Investors potentially will lose money when the official data show 250 people dead; responding agencies and countries potentially get money for the same. Yet 249 deaths yield dramatically different results. People on both sides of the ledger are hedging their bets. Ministry officials in Sierra Leone have told me that they need ‘bad numbers’ to get foreign assistance. I found in earlier research that one of the ways they accomplish this is by not collecting health data from clinics known for their good outcomes. On the investor side, deflating death-rate data would be as easy as hiring enumerators for more lucrative work, thereby delaying data collection, or hacking into smart phones to alter data. There are many creative ways to play with data triggers, if that’s what stands between money for investors or money for receiving countries.

So much money is riding on the counts that I too must reckon with the potential impacts of my research. An investor told me, ‘If the event happens and investors feel like it wasn’t fairly calculated or there was some monkey business going on, then the market isn’t going to be around for long’. My work pulls back the curtain to show how the data is collected, counted, analyzed, and applied. Will the real-time wobbliness of the data deter potential investors? Will it derail the PEF? Maybe. In the investor worlds I entered, though, I found that investors are mostly agnostic. They go where the money is to be made. If not with pandemic bonds 1.0, then maybe with 2.0 or 3.0. Or they will go elsewhere completely. This is another risk to reckon with: in a possible future where pandemic risk management has been turned over to capital markets after government aid drops to historic lows, how will pandemics be funded if investors flee?

Insuring futures: Whose?

For some time now, the performance and even the viability of the World Bank has been in question. No friend of the Bank, the Financial Times regularly questions its relevance (see, for example, Financial Times 2014), along with other powerful North American and European international-development and finance establishments. The development economist Jeffery Sachs (2012) argues that the World Bank ‘has lacked a clear direction’, ‘solved far too few global problems’, and ‘completely fumbled the exploding pandemics of AIDS, tuberculosis, and malaria during the 1990s’. In a more recent article, in which he took a direct swipe at the World Bank’s Wall Street and Davos leanings, Sachs (2018) pointedly praised funding that used ‘outright grants, not Wall Street loans. Fighting AIDS in poor countries was not viewed as a revenue-generating investment needing fancy financial engineering’. Likewise, an article in the New York Times explored the link between the World Bank’s organizational viability and private-investor profit: ‘In a search for relevance, the bank’s president is altering its approach. … He is pushing private investors – sovereign wealth funds, private equity firms and insurance companies – to pony up trillions of dollars for projects. … They can reap rich returns by putting their money to work alongside the World Bank’ (Thomas 2018).

Reckoning with the pandemic bond means sorting out who has what to gain from its success as a financial device. In early 2015, the World Bank invited ‘some of the largest reinsurance companies in the world’ to help build the pandemic bond, a World Bank interlocutor told me:

Several [reinsurance companies] expressed interest, and we had conversations with them. But then, ultimately, they started dropping out. I mean, at that time, we didn’t know what the PEF would look like. But we said we were interested in partnering with the private sector to put together some sort of mechanism that will help insure countries against the next disease. Ultimately, there were just two that remained interested. They had some comfort in working with the bank because they also worked with the bank on the cat bonds.

I was told that the World Bank paid out about US$1 million to build the pandemic bond, and that the reinsurance companies[note 9] worked pro bono because they were very interested in developing the pandemic bond instrument. Since the 2017 PEF bond initial offering, they have already made US$37 million per year on PEF bond premiums. One economist told me that the reinsurance companies involved in the PEF ‘are expecting to make over $100 million’ on the pandemic bond premiums alone. They have a lot more to gain financially if a pandemic bond market becomes established along the lines of the green and cat bond models. Reinsurers were in it to develop and influence a market that they would be able later to invest in. Their financial security and profit depend on them being able to diversify their own portfolios and spread around their own risk, much as they have done in the cat bond market. A reinsurance executive bluntly explained that just making the pandemic bond alone would not have been worth it: ‘The amount of effort that we [the reinsurance company structuring the pandemic bond] had to invest into it, it was [a] very long and intensive time of work with many, many experts involved, lots of discussions going on. It’s only worth it against the hope that this effort would create a new market. Otherwise the costs involved in developing these types of solutions would be too high’.

But a well-known European economist familiar with the pandemic bond’s mechanics put the reinsurance companies’ interest in a different light: ‘It really doesn’t make much sense when the world’s resources for health care for people in poor countries are very scarce. So, adopting the design where half the money, on average, goes to an insurance company is kind of crazy’.

Dead reckoning

Dead reckoning is a navigational method that uses known plot points to set a direction (Blowditch 2002). It is an apt metaphor for anticipating whether pandemic bonds will establish and continue. What has the pandemic bond launched? Is turning back possible? Given the years in the making, the socialities between the World Bank, the bond brokers, the donor countries, and the reinsurance and data companies, and these parties’ investments of time and money, and all the favors asked, all the chits called in, and all the objections overcome to make the device, to set the stage for a new market, to get the job done, I ask: Is the future of pandemic response aid open? Or do the creation and the processes of the pandemic bond foreclose alternatives? Could pandemic security be returned to governments? Is it stubborn naïveté to continue to imagine worlds where investments in good government produce less financially motivated care? Could the bond as a global health finance device ever fail completely, given that there is so much from the so powerful at stake? Is there an equivalent here to ‘too big to fail’ (too much time spent, too many favors, too many promises, too many concessions, too much exchange)? Can any level of reckoning undo the bond making (double entendre intended) of the pandemic bond?

The ethical stakes of this reckoning ratcheted up a notch when the World Bank invited the reinsurance industry to the pandemic bond design process. The insurance industry’s role in Black Atlantic capitalism in the eighteenth century and its production of ‘interest-bearing bodies’ is instructive. Baucom (2005) tells of a British merchant vessel, the Zong, that sailed the Atlantic Ocean in 1781 en route to Jamaica, with 440 West Africans who would be sold as slaves in Caribbean slave markets. The ship went off course, extending the voyage. Food and water ran low. To compensate – and knowing he could claim insurance for lost ‘cargo’ – the captain directed that 132 men, women, and children from West Africa be thrown overboard, a premeditated mass murder at sea. When the ship arrived in Jamaica, its captain and owners claimed loss of insured property, at £30 per person. The insurers refused to pay; the captain and owner sued. The insurers were ordered to pay. The case was taken for appeal in a higher court, whose chief justice was intent on building England’s economy through his insurance law project (Krikler 2007, 35). The judge had found English commercial law ‘inadequate to the task of improving the efficiency of a burgeoning capitalism and ensuring the security of property and the integrity of business transactions’, including the slave trade (Krikler 2007, 42). Eschewing murder charges, the judge upheld the insurance contract. By the late eighteenth century, British insurance companies were insuring marine contracts, including covering ships carrying enslaved Africans, worth around £100,000,000 a year, which would be billions of pounds today (Krikler 2007, 32). Britain’s shipping industry and navy are widely considered essential to England’s nineteenth- and early-twentieth-century capital accumulation and domination. The association between insurance and profit-for-some – who uses insurance for what, why, and how much – is a historied and racist one.

When I learned of the 2018 Ebola outbreak in the DRC, my involuntary first thought was of the number dead and whether the pandemic bond had been triggered for aid. I checked the numbers; the death data hadn’t triggered the bond. Investors did not lose their money. Two weeks after the first Ebola cases in the DRC were confirmed, the PEF cash-pot mechanism, not the pandemic bond, kicked in. In May 2018, US$12 million from the cash pot was disbursed. The World Bank congratulated itself for moving the dial away from panic and neglect (Evans 2018). It took credit for the money being there, at the ready. Another US$20 million was disbursed in February 2019; US$10 million more was disbursed in May 2019. Deaths mounted, but no matter how many people die in a single country, the pandemic bond money cannot contractually be released as aid until the disease crosses the country’s border. A colleague wrote to me, ‘Saw the PEF numbers are at trigger level but still waiting for the border jump. What a bizarre and twisted situation!’ Then in June 2019, Ebola was confirmed in Uganda. But for the bond to trigger, there are still more conditions: there must be at least twenty deaths and the growth-rate threshold must be met. In August 2019, US$300 million was released for Ebola care from the cash window and other World Bank accounts. Two thousand dead, and still the bond did not trigger.

I continue to track the death data from the DRC outbreak, and reckon with the role of the data just as I continue to reckon with the bond. I am skeptical. I am not there in the Congo. I do not know if more people may have died only to elude count. I am not privy to the conversations in the ministries or to the whisperings of community members. I am not hanging out with the enumerators. Do they have gasoline for their motorcycles? Are they allowed into villages where people are dying from Ebola? What kind of data-collection schedules are they on?And then I catch myself. The death data is both the mainstage and the sideshow in the PEF schematic. Splitting off data from the actual health of populations is normal practice now (Erikson 2012), and care need not even be delivered for a financial device to ‘succeed’. Counting the dead has long been a political act of states, and now it is becoming a special interest of global financiers.

Are pandemic and development impact bonds the future of global health and humanitarian aid? All things considered, maybe they are. And if they are, let’s prepare and reckon with how we as a global community will pay for care during pandemics and other crisis events if investors flee and governments can’t or won’t pay. Is this the future we want? Let’s reckon with this now before the global health bond slot becomes a financial juggernaut, government coffers atrophy further, and pandemic problem solving becomes more circumscribed.

Acknowledgments

Research for this project was supported by the Social Science and Humanities Research Council of Canada; Simon Fraser University; a sabbatical fellowship at the Centre for Global Cooperation Research in Duisburg, Germany; and a 2016 Mercator Fellowship at the University of Halle, Germany. Special thanks to enumerators in Sierra Leone, the article’s anonymous interlocutors, the 2014 SFU-Salone ethnographic research team, the other authors in this special issue, the Stanford Department of Anthropology and Simon Fraser University School for International Studies colloquium groups, Baindu Kosia, Sam Eglin, Musu Abdulai, Puneet Grewal, Iveoma Udevi-Aruevoru, Earum Chaudhary, and Abou Farman. Deep thanks to Richard Rottenburg for lively, long-term encouragement and engagement with this project. Gary Parker was extremely helpful with the interest calculations, though any remaining mistakes are my own.

About the author

Susan Erikson is a medical anthropologist who studies highly complex political and economic systems that shape human health experiences. She is Professor of Global Health in the Faculty of Health Sciences at Simon Fraser University in Vancouver, British Columbia, Canada.

References

AAA. 2017. ‘Bending the Arc of Change: A Conversation with Paul Farmer and Jim Yong Kim’. Filmed 29 November 2017 at the 116th Annual Meeting of the American Anthropological Association (AAA), Washington, DC. YouTube video. https://www.youtube.com/watch?v=uwCIfJkUVNE.

Artemis. 2018a. ‘Catastrophe Bond & ILS Risk Capital Issued and Outstanding by Year’. http://www.artemis.bm/dashboard/catastrophe-bonds-ils-issued-and-outstanding-by-year/.

Artemis. 2018b. ‘IBRD CAR 111-112. Catastrophe Bonds, Insurance Linked Securities, Reinsurance Capital & Risk Transfer Intelligence’. http://www.artemis.bm/deal_directory/ibrd-car-111-112/.

Artemis. 2019. ‘Outstanding Market’. http://www.artemis.bm/dashboard/.

Basu, Sanjay, Megan A. Carney, and Nora J. Kenworthy. 2017. ‘Ten Years after the Financial Crisis: The Long Reach of Austerity and Its Global Impacts on Health’. Social Science and Medicine 187 (August): 203–207. https://doi.org/10.1016/j.socscimed.2017.06.026.

Baucom, Ian. 2005. Specters of the Atlantic: Finance Capital, Slavery, and the Philosophy of History. Durham, NC: Duke University Press.

Biruk, Crystal. 2018. Cooking Data: Culture and Politics in an African Research World. Durham, NC: Duke University Press.

Blowditch, Nathaniel. 2002. ‘Chapter 7: Dead Reckoning’. The American Practical Navigator, TheNauticalAlmanac.com. https://thenauticalalmanac.com/Bowditch-%20American%20Practical%20Navigator.html.

Brookings Institution. 2018. ‘What Can We Learn from the Results of the World’s First Development Impact Bond in Education’. Panel at the Brookings Institution, Washington, DC, 13 July. Video transcript. https://www.brookings.edu/wp-content/uploads/2018/07/global_20180713_impact_bonds_transcript.pdf.

City of New York. 2012. Fact Sheet: The NYC ABLE Project for Incarcerated Youth. Last modified 2 August 2012. http://www.payforsuccess.org/sites/default/files/resource-files/nyc_sib_fact_sheet_0.pdf.

Cohen, Donald, and Jennifer Zelnick. 2015. ‘What We Learned from the Failure of the Rikers Island Social Impact Bond’. Nonprofit Quarterly, 7 August. https://nonprofitquarterly.org/2015/08/07/what-we-learned-from-the-failure-of-the-rikers-island-social-impact-bond/.

Cooper, Melinda, and Martijn Konings. 2015. ‘Pragmatics of Money and Finance: Beyond Performativity and Fundamental Value’. Journal of Cultural Economy 9 (1): 1–4. https://doi.org/10.1080/17530350.2015.1117516.

Dodge, Kenneth A. 2015. ‘Why Social Impact Bonds Still Have Promise’. New York Times, 13 November. https://www.nytimes.com/2015/11/14/business/dealbook/why-social-impact-bonds-still-have-promise.html.

Dumit, Joseph. 2012. Drugs for Life: How Pharmaceutical Companies Define Our Health. Durham, NC: Duke University Press.

Economist. 2017. ‘A New Bond Taps Private Money for Aid Projects in War Zones’. Economist, 7 September. https://www.economist.com/finance-and-economics/2017/09/07/a-new-bond-taps-private-money-for-aid-projects-in-war-zones.

Erikson, Susan L. 2012. ‘Global Health Business: The Production and Performativity of Statistics in Sierra Leone and Germany’. Medical Anthropology 31 (4): 367–84. https://doi.org/10.1080/01459740.2011.621908.

Evans, Tim. 2018. ‘Moving away from Panic and Neglect: A Big Step Forward on Pandemic Preparedness and Response’. Investing in Health, World Bank blogs, 7 June. http://blogs.worldbank.org/health/moving-away-panic-and-neglect-big-step-forward-pandemic-preparedness-and-response.

Financial Times. 2014. ‘Restructuring Hell at the World Bank: Jim Yong Kim Should Get a Grip on the Troubled Institution’. Last modified 9 April 2014. https://www.ft.com/content/9244beca-bff5-11e3-b6e8-00144feabdc0.

Grépin, Karen. 2015. ‘International Donations to the Ebola Virus Outbreak: Too Little, Too Late?’ BMJ 350, h376: 1–5. https://doi.org/10.1136/bmj.h376.

Haraway, Donna J. 2016. Staying with the Trouble: Making Kin in the Chthulucene. Durham, NC: Duke University Press.

IDinsight. 2018. Educate Girls Development Impact Bond: Final Evaluation Report. Last modified 15 June 2018. https://www.educategirls.ngo/pdf/Educate-Girls-DIB-Final-Evaluation-Report_2018-06-10.pdf.

Instiglio. 2015. Educate Girls Development Impact Bond: Improving Education for 18000 Children in Rajasthan. Last modified 28 January 2016. http://instiglio.org/educategirlsdib/wp-content/uploads/2016/03/EG-DIB-Design-1.pdf.

Kentikelenis, Alexander, Lawrence King, Martin McKee, and David Stuckler. 2014. ‘The International Monetary Fund and the Ebola Outbreak’. Lancet 3 (2): e69–e70. https://doi.org/10.1016/S2214-109X(14)70377-8.

Kingori, Patricia, and René Gerrets. 2016. ‘Morals, Morale, and Motivations in Data Fabrication: Medical Research Fieldworkers’ Views and Practices in Two Sub-Saharan African Contexts’. Social Science and Medicine 166 (1): 150–59. https://doi.org/10.1016/j.socscimed.2016.08.019.

Krikler, Jeremy. 2007. ‘The Zong and the Lord Chief Justice’. History Workshop Journal 64 (1): 29–47. https://doi.org/10.1093/hwj/dbm035.

Madsbjerg, Saadia, and Georgia L. Keohane. 2016. ‘The Innovative Finance Revolution: Private Capital for the Public Good’. Last modified 31 January 2017. https://assets.rockefellerfoundation.org/app/uploads/20170215144835/FARockefellerFinalPDF_1.pdf.

McClellan, Mark, James Kent, Stephen J. Beales, Samuel I. A. Cohen, Michael Macdonnell, Andrea Thoumi, Mariam Abdulmalik, and Ara Darzi. 2014. ‘Accountable Care around the World: A Framework to Guide Reform Strategies’. Health Affairs 33 (9): 1507–15.

Nabarro, David, and Frank Schroeder. 2017. ‘Advancing Universal Development Goals through the Breathtaking Power of Innovation’. In ‘The Innovative Finance Revolution: Private Capital for Public Good’, special issue, Foreign Affairs presented with the Rockefeller Foundation, edited by Saadia Madsbjerg and Georgia Keohane, 100–108. https://assets.rockefellerfoundation.org/app/uploads/20170215144835/FARockefellerFinalPDF_1.pdf.

Nelson, Diane M. 2009. Reckoning: The Ends of War in Guatemala. Durham, NC: Duke University Press.

Pfeiffer, James, and Rachel Chapman. 2010. ‘Anthropological Perspectives on Structural Adjustment and Public Health’. Annual Review of Anthropology 39: 149–65. https://doi.org/10.1146/annurev.anthro.012809.105101.

Rosenberg, Tina. 2018. ‘Issuing Bonds to Invest in People’. New York Times, 6 March. https://www.nytimes.com/2018/03/06/opinion/social-projects-investing-bonds.html.

Rosling, Hans, and British Broadcasting Company. 2010. ‘Hans Rosling’s 200 Countries, 200 Years, 4 Minutes – The Joy of Stats – BBC Four’. YouTube video. https://www.youtube.com/watch?v=jbkSRLYSojo.

Rudd, Timothy, Elisa Nicoletti, Kristin Misner, and Janae Bonsu. 2013. Financing Promising Evidence-Based Programs: Early Lessons from the New York City Social Impact Bond. New York: MDRC. Last modified December 2013. https://www.mdrc.org/sites/default/files/Financing_Promising_evidence-Based_Programs_FR.pdf.

Sachs, Jeffrey D. 2012. ‘A World Bank for a New World’. Project Syndicate, 24 February. https://www.project-syndicate.org/commentary/a-world-bank-for-a-new-world.

Sachs, Jeffrey D. 2018. ‘The World Bank Needs to Return to Its Mission’. Project Syndicate, 9 February. https://www.project-syndicate.org/commentary/world-bank-bad-wall-street-strategy-by-jeffrey-d-sachs-2018-02.

SEC. 2013. ‘Investor Bulletin: Accredited Investors’. Investor.gov, 23 September. Washington, DC: US Securities and Exchange Commission. https://www.investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-accredited-investors.

Shepler, Susan. 2017. ‘“‘We Know Who Is Eating the Ebola Money!”’: Corruption, the State, and the Ebola Response’. Anthropology Quarterly 88 (3): 457–79.

Soucat, Agnés, Elina Dale, Inke Mathauer, and Joseph Kutzin. 2017. ‘Pay-for-Performance Debate: Not Seeing the Forest for the Trees’. Health Systems & Reform 3 (2): 74–79.

Stein, Felix, and Devi Sridhar. 2017. ‘Health as a “Global Public Good”: Creating a Market for Pandemic Risk’. BMJ 358: 1–4. https://doi.org/10.1136/bmj.j3397.

Sunder Rajan, Kaushik. 2012. ‘Pharmaceutical Crises and Questions of Value: Terrains and Logics of Global Therapeutic Politics’. South Atlantic Quarterly 111 (2): 321–46.

SwissRe. 2018. ‘Reinsurance Non-Life’. http://reports.swissre.com/2017/financial-report/financial-year/market-environment/reinsurance-non-life.html#.

Thomas, Landon, Jr. 2018. ‘The World Bank Is Remaking Itself as a Creature of Wall Street’. New York Times, 25 January. https://www.nytimes.com/2018/01/25/business/world-bank-jim-yong-kim.html.

Tweed, Katherine. 2016. ‘A New Record for Clean Energy Investment: It Is Very Hard to See These Trends Going Backward’. Greentech Media, 15 January. https://www.greentechmedia.com/articles/read/clean-energy-investment-hits-new-record-in-2015#gs.PY5d9Hk.

United Nations. 2009. Innovative Financing for Development: The I-8 Group Leading Innovative Financing for Equity (L.I.F.E). Last modified December 2009. https://www.un.org/esa/ffd/wp-content/uploads/2014/09/InnovativeFinForDev.pdf.

Wilkinson, A., and M. Leach. 2014. ‘Briefing: Ebola – Myths, Realities, and Structural Violence’. African Affairs 114: 136–48. https://doi.org/10.1093/afraf/adu080.

World Bank. 2014a. ‘World Bank Group President Calls for New Global Pandemic Emergency Facility’. 10 October. http://www.worldbank.org/en/news/press-release/2014/10/10/world-bank-group-president-calls-new-global-pandemic-emergency-facility.

World Bank. 2014b. ‘World Bank Issues Its First Ever Catastrophe Bond Linked to National Hazard Risks in Sixteen Caribbean Countries’. Last modified 30 June 2014. http://www.worldbank.org/en/news/press-release/2014/06/30/world-bank-issues-its-first-ever-catastrophe-bond-linked-to-natural-hazard-risks-in-sixteen-caribbean-countries.

World Bank. 2016a. Pandemic Emergency Financing Facility: Global Pandemic Response through a Financial Intermediary Fund. Last modified 8 July 2016. http://documents.worldbank.org/curated/en/354341467990992248/pdf/104838-BR-R2016-0071-Box394885B-OUO-9.pdf.

World Bank. 2016b. ‘Speech by World Bank Group President Jim Yong Kim at the Annual Meetings Plenary’. Speeches & Transcripts. 7 October. https://www.worldbank.org/en/news/speech/2016/10/07/plenary-speech-by-world-bank-group-president-jim-yong-kim-2016.

World Bank. 2016c. ‘World Bank Group Launches Groundbreaking Financing Facility to Protect Poorest Countries against Pandemics’. Last modified 21 May 2016. http://www.worldbank.org/en/news/press-release/2016/05/21/world-bank-group-launches-groundbreaking-financing-facility-to-protect-poorest-countries-against-pandemics.

World Bank. 2017a. Operations Manual: Pandemic Emergency Financing Facility. Last modified 2 November 2017. http://pubdocs.worldbank.org/en/168391509719305386/PEF-Operations-Manual-September-13-2017.pdf.

World Bank. 2017b. Pandemic Emergency Financial Facility (PEF) Framework. Last modified 26 October 2017. http://pubdocs.worldbank.org/en/670191509025137260/PEF-Framework.pdf.

World Bank. 2017c. Prospectus Supplement. Last modified 17 June 2018. http://pubdocs.worldbank.org/en/882831509568634367/PEF-Final-Prospectus-PEF.pdf.

World Bank. 2019. Pandemic Emergency Financing Facility (PEF): Operational Brief for Eligible Countries. Last modified 12 February 2019. http://pubdocs.worldbank.org/en/478271550071105640/PEF-Operational-Brief-Feb-2019.pdf.

Zack-Williams, Tunde. 2012. When the State Fails: Studies on Intervention in the Sierra Leone Civil War. London: Pluto.

Endnotes

1 Back